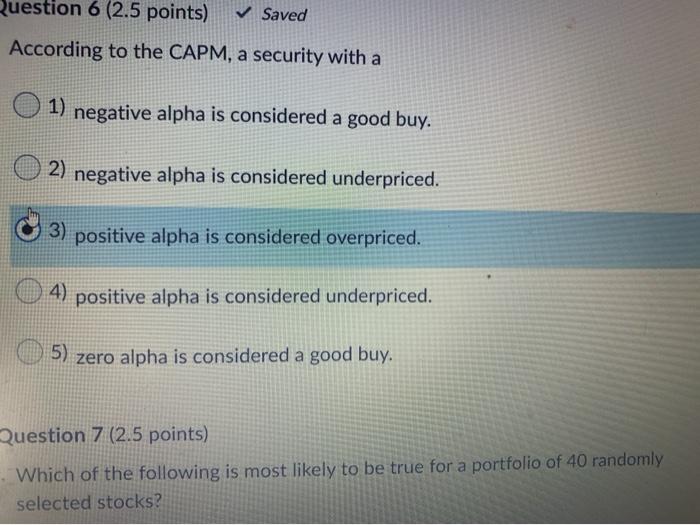

Solved According to the CAPM, overpriced securities should

Por um escritor misterioso

Descrição

Answer to Solved According to the CAPM, overpriced securities should

Capital Asset Pricing Model (CAPM)

Solved Question 6 (2.5 points) ✓ Saved According to the

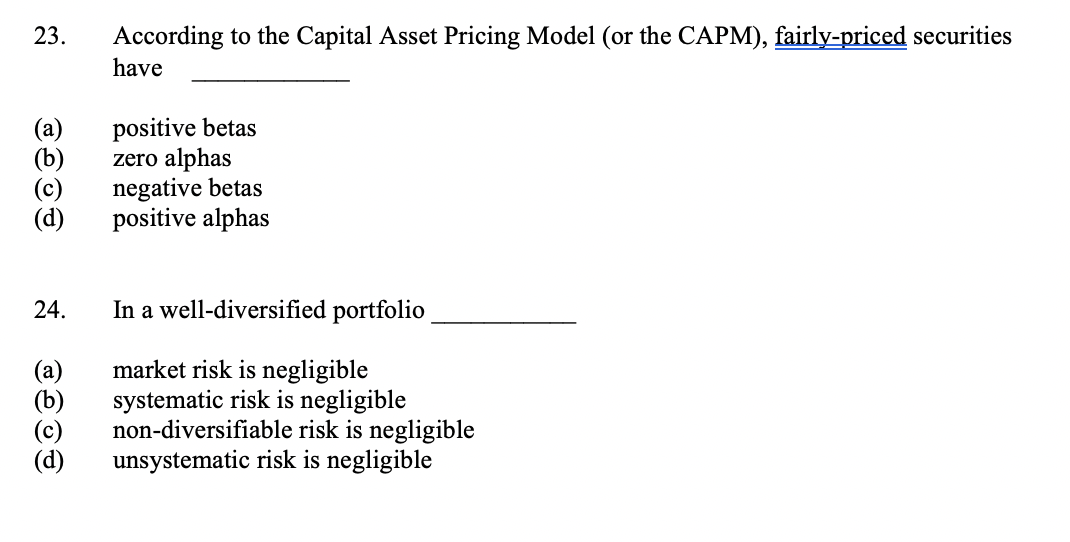

Solved 23. According to the Capital Asset Pricing Model (or

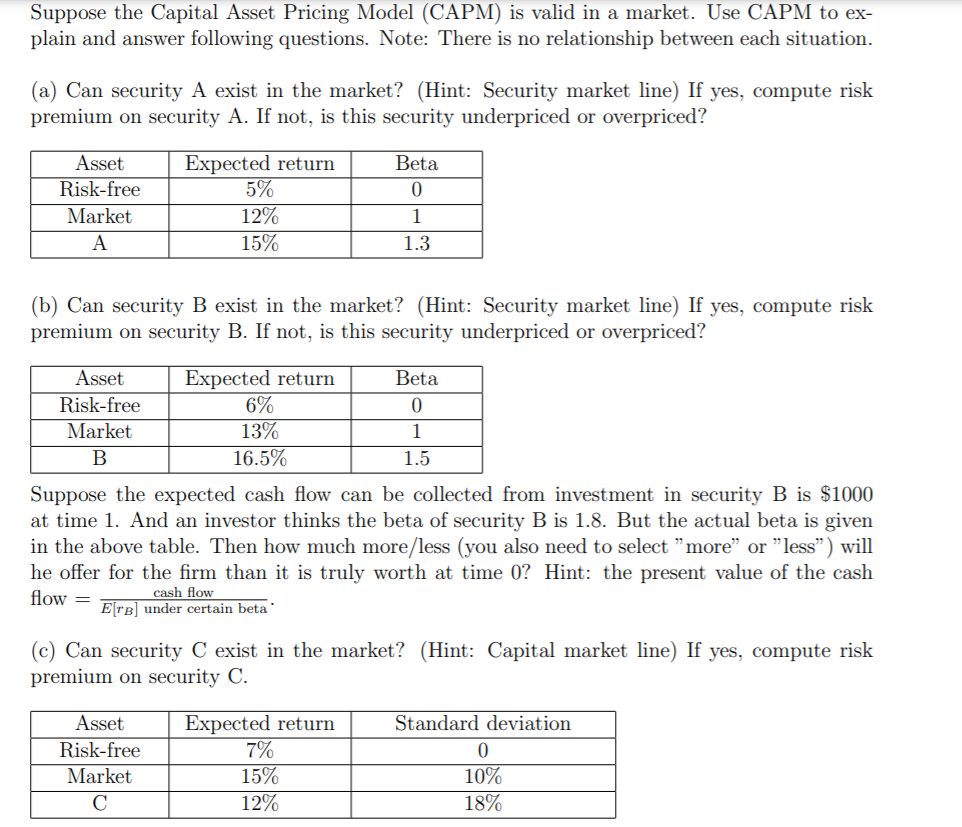

Solved Suppose the Capital Asset Pricing Model (CAPM) is

Chapter 09 MCQs, PDF, Capital Asset Pricing Model

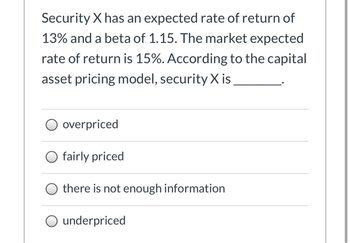

Answered: Security X has an expected rate of…

FIN 571 Academic Adviser tutorialrank.com by beautyredrose7 - Issuu

Security Expected Return Estimated Return A: Capital Asset Pricing Model ( CAPM), PDF, Capital Asset Pricing Model

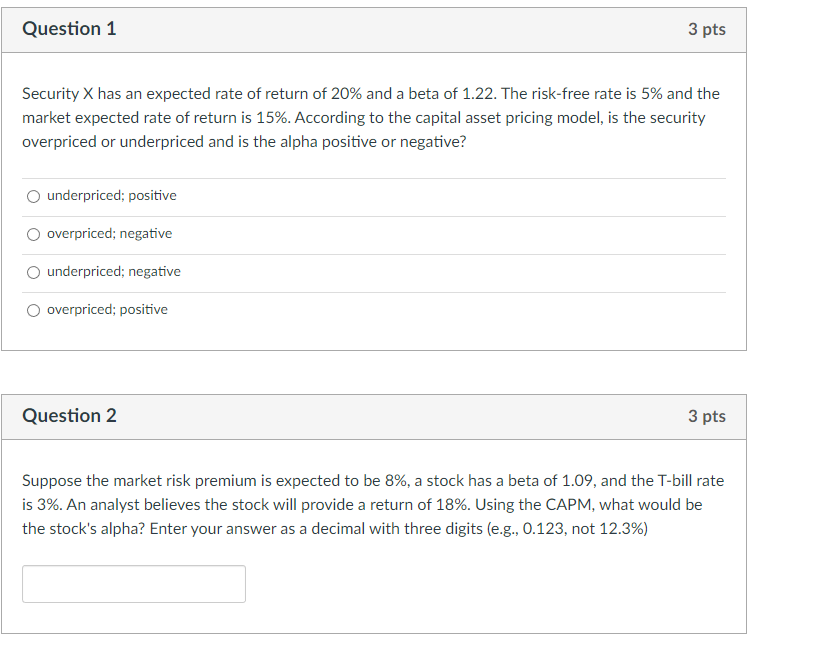

Solved Security X has an expected rate of return of 20% and

Answered: Suppose the Capital Asset Pricing Model…

Is a stock overvalued or undervalued if its average return (calculated using historical data) is higher than its expected return (CAPM model)? - Quora

Solved] we discussed the CAPM model and its implications. What is the

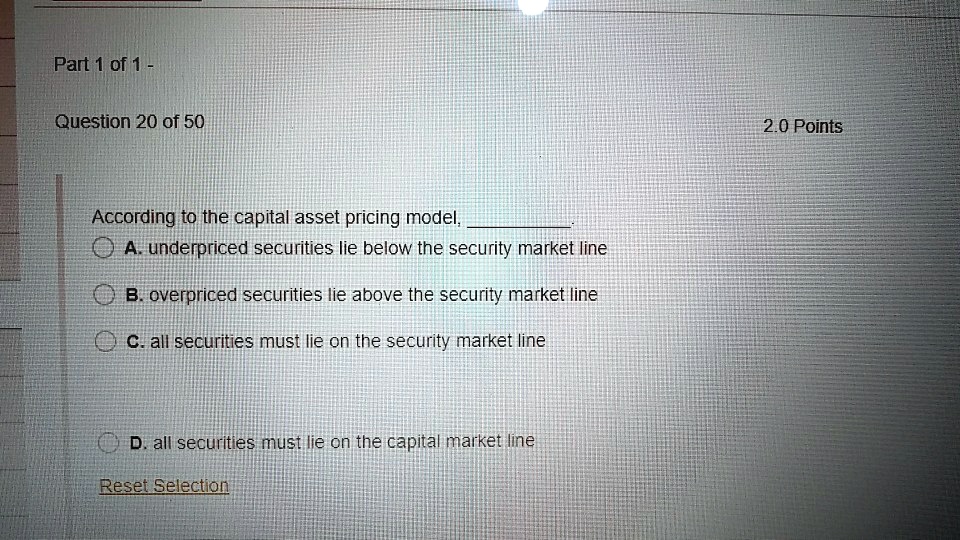

SOLVED: According to the capital asset pricing model, underpriced securities lie below the security market line, overpriced securities lie above the security market line, and all securities must lie on the capital

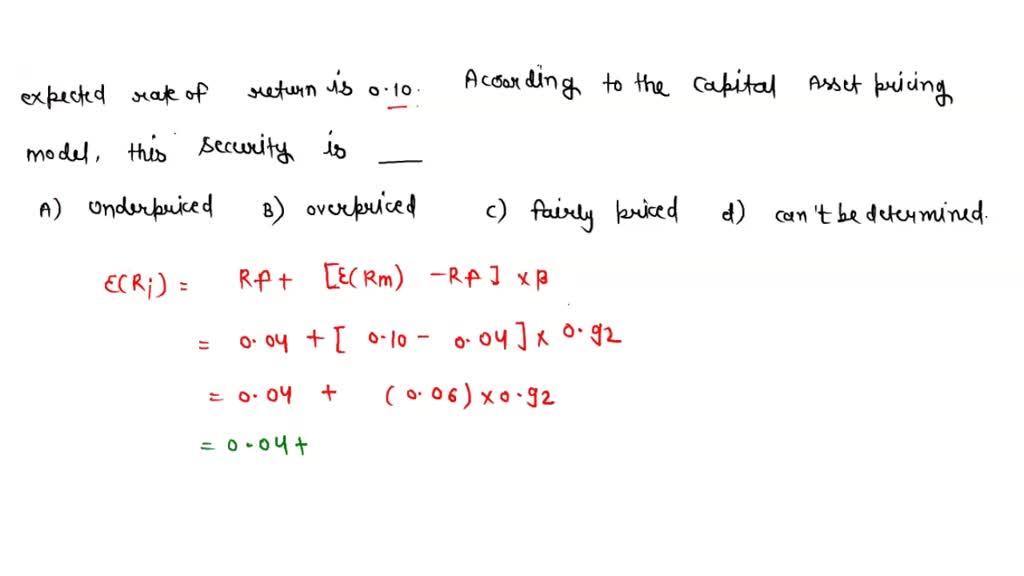

SOLVED: Your opinion is that Boeing has an expected rate of return of 0.08. It has a beta of 0.92. The risk-free rate is 0.04 and the market expected rate of return

de

por adulto (o preço varia de acordo com o tamanho do grupo)