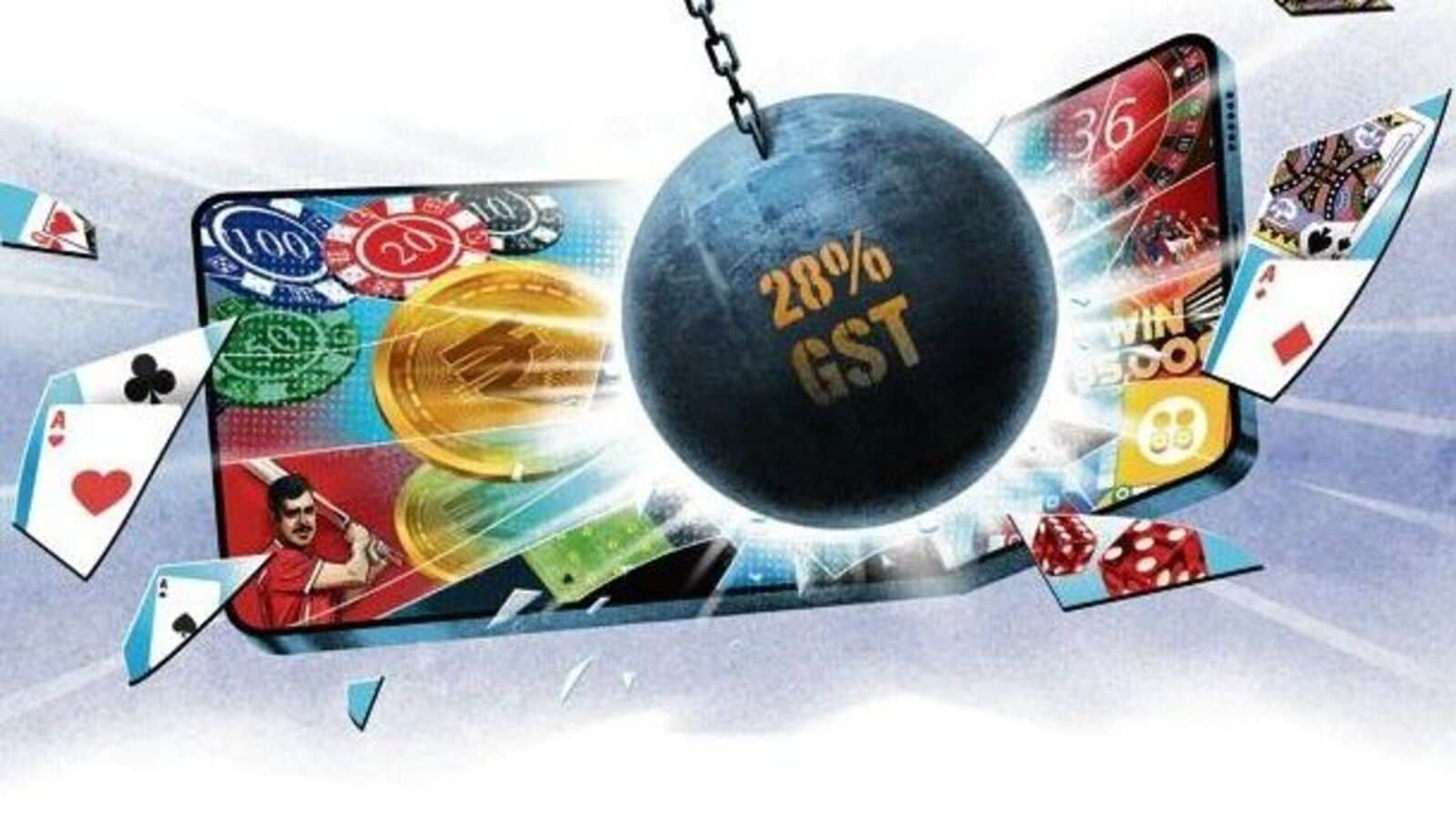

Online money gaming firms face massive Rs 45,000 crore tax demand

Por um escritor misterioso

Descrição

India Business News: The Central Board of Indirect Taxes and Customs (CBIC) has evaluated unsettled GST liabilities for these firms since 2017.

Taxes Online: Latest News, Videos and Photos of Taxes Online

Jet Airways, Akasa, Air India To Write Next Chapter Of Indian

)

Online gaming industry agrees for 28% GST only on GGR not on entry

Online gaming firms stare at Rs 45,000 crore GST demand; Digital

Online gaming companies get Rs 1 lakh crore GST show cause notices

The survival play of real-money gaming firms

Nirmala Sitharaman Highlights: Easier loans for MSMEs; income tax

Types of Tax - Exemptions, Due Dates & Penalties

Online Gaming Platforms Face Potential Rs 45,000 Crore Tax

Skill-Based Online Games Can Be Asked To Pay Rs 45,000 Crore Tax

Online gaming firms stare at Rs 45,000 crore GST demand; Digital

Court stays ₹21,000 crore tax demand on online gaming firm

Technology Law & Policy News, 2021 : Plan C

Gaming: Real-money gaming companies face an increasing hostile

de

por adulto (o preço varia de acordo com o tamanho do grupo)