Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Descrição

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

Employee Retention Credit (ERC): Frequently Asked Qestions

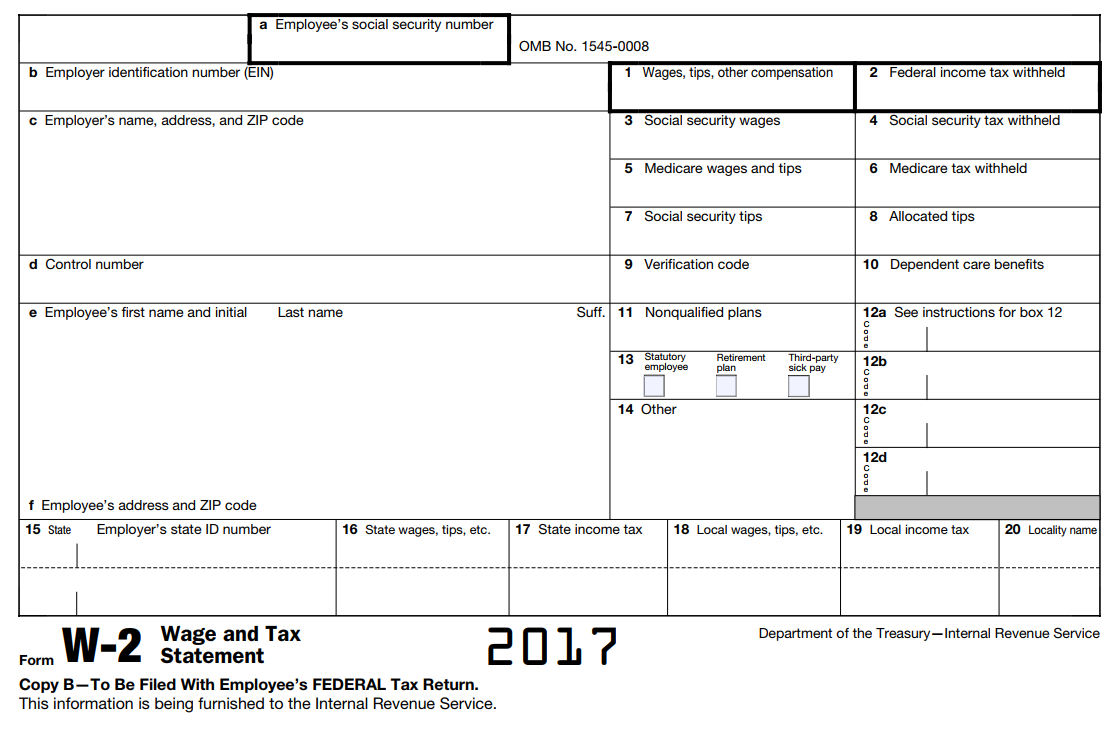

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

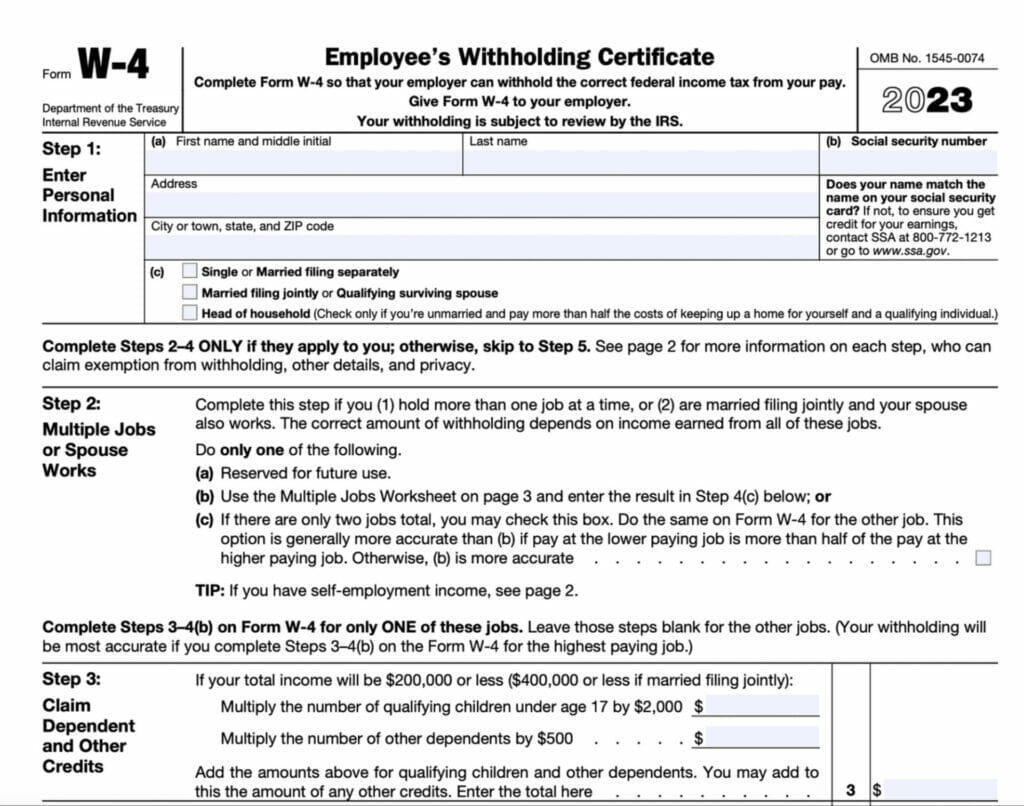

What Is the Difference Between Forms W-4, W-2, W-9 & 1099-NEC?

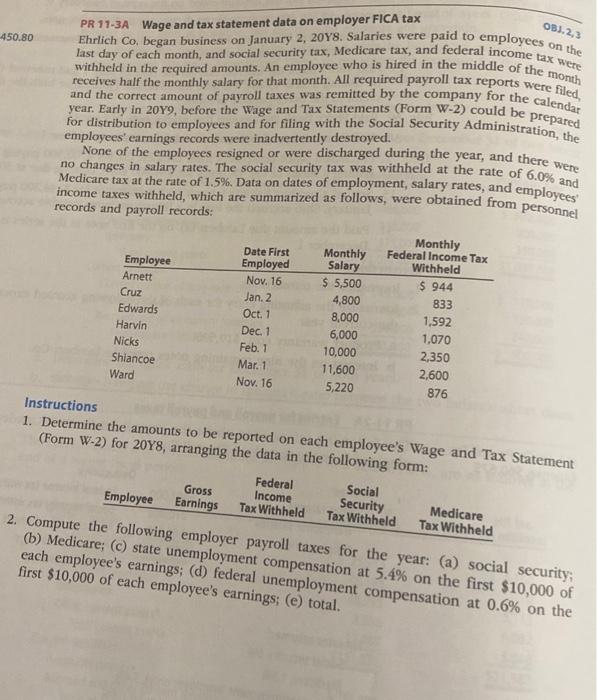

Solved PR 11-3A Wage and tax statement data on employer FICA

Payroll tax returns - What are they, and who needs to file them

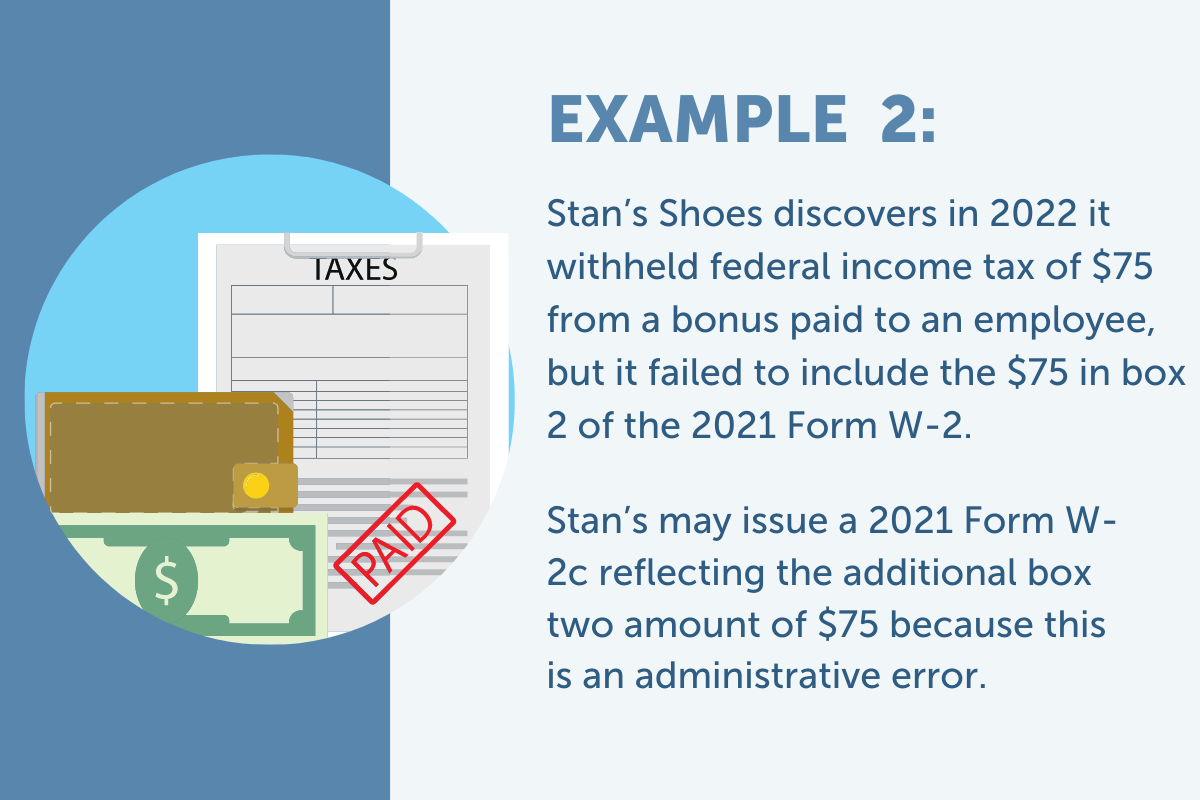

How to Avoid W-2 Form Errors

IRS Form 941 Filing Requirements for Businesses in the Beauty

FICA Tax Refunds for W2 Employees That Change Jobs or Have

No Form W-2, Wage and Tax Statement? Get Help From IRS

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2019/j/v/OHKfCvSly4UaM30VUNag/brincadeiras.png)