Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Descrição

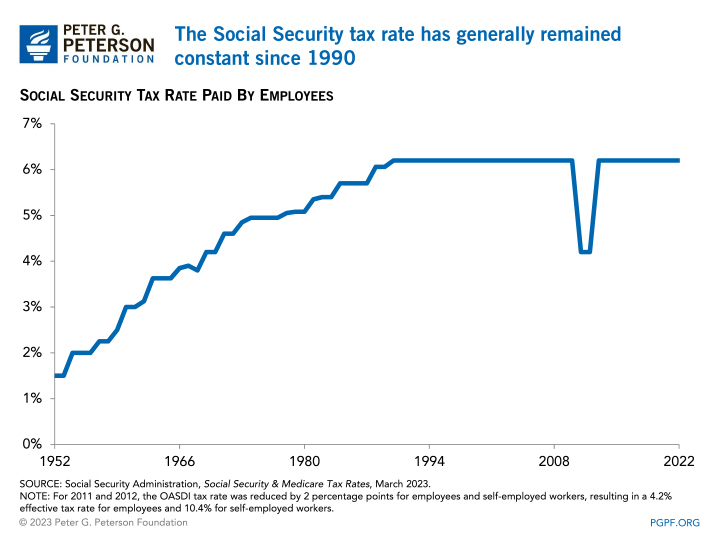

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

2017 FICA Tax: What You Need to Know

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Payroll Taxes: What Are They and What Do They Fund?

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

Keyword:current fica tax rate - FasterCapital

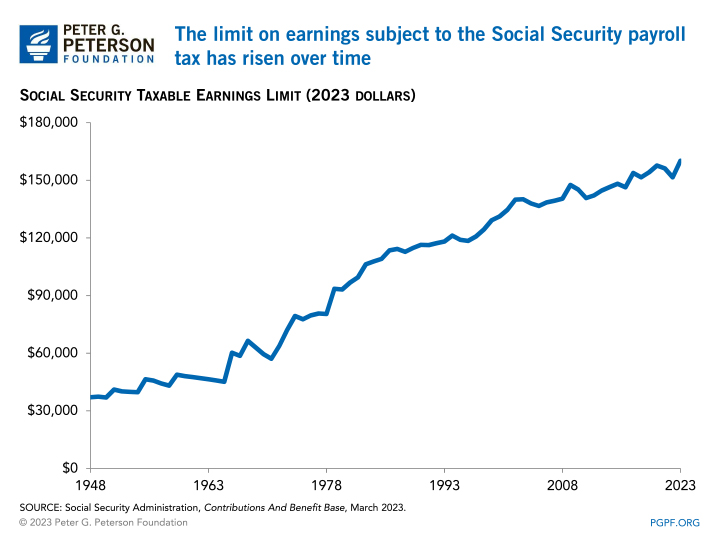

2021 Wage Cap Rises for Social Security Payroll Taxes

Social Security wage base is $160,200 in 2023, meaning more FICA

How to Pay Social Security and Medicare Taxes: 10 Steps

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

What is FICA Tax? - The TurboTax Blog

Payroll Taxes: What Are They and What Do They Fund?

fica tax - FasterCapital

de

por adulto (o preço varia de acordo com o tamanho do grupo)

)